ad valorem tax florida ballot

An ad valorem tax which is Latin for according to value is any tax imposed on the basis of the monetary value of the taxed item. 1 MILLAGE AUTHORIZED NOT TO EXCEED 2 YEARS.

Duval School Board Votes 6 1 To Put Property Tax Onto August Ballot Wjct News

Ad valorem tax florida ballot Monday February 7 2022 Edit.

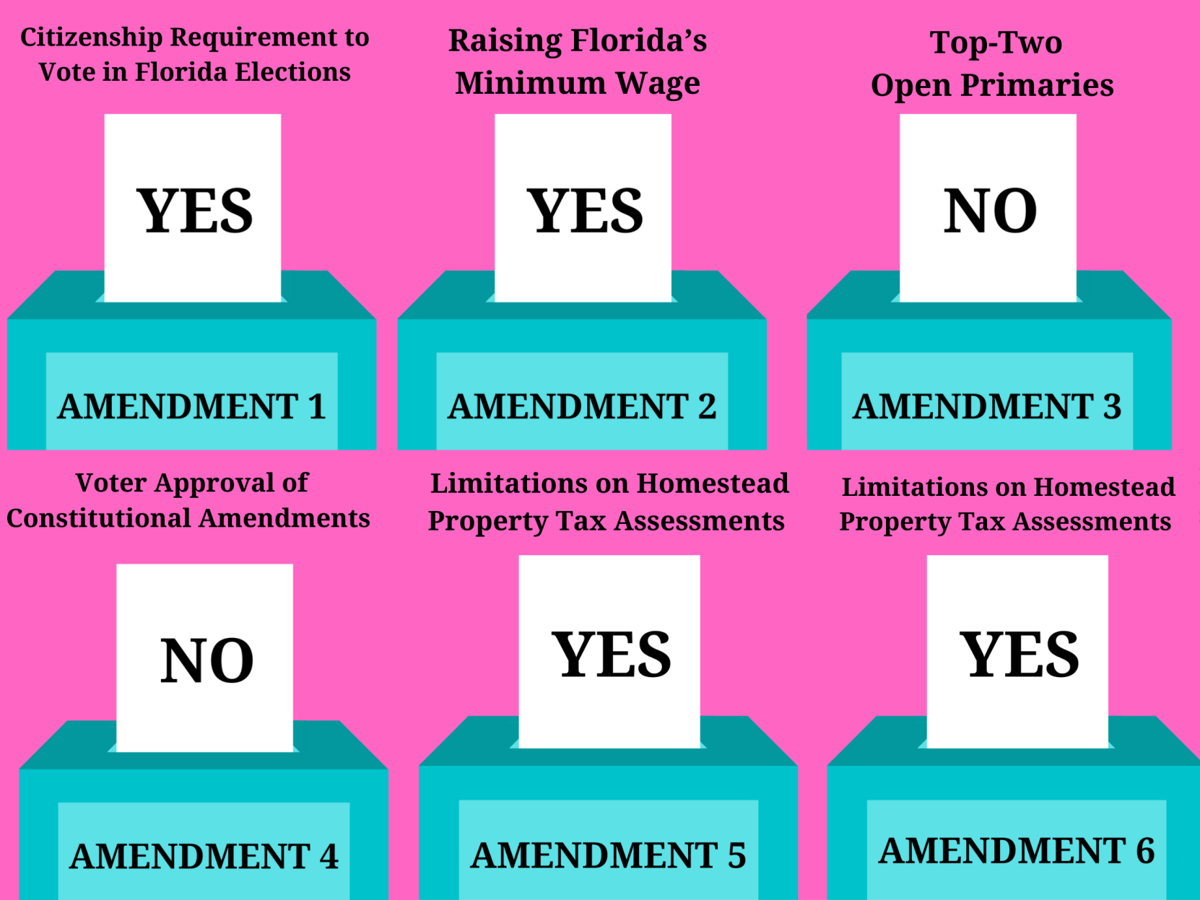

. Home ad ballot florida tax. Amendments 5 And 6 On Florida S Ballot Focus On Florida Property Taxes The Independent Florida Alligator Six Florida Constitutional Amendments Appear On This Year S Ballot 2020 Amendments Chronicleonline Com. Impact fees and user charges.

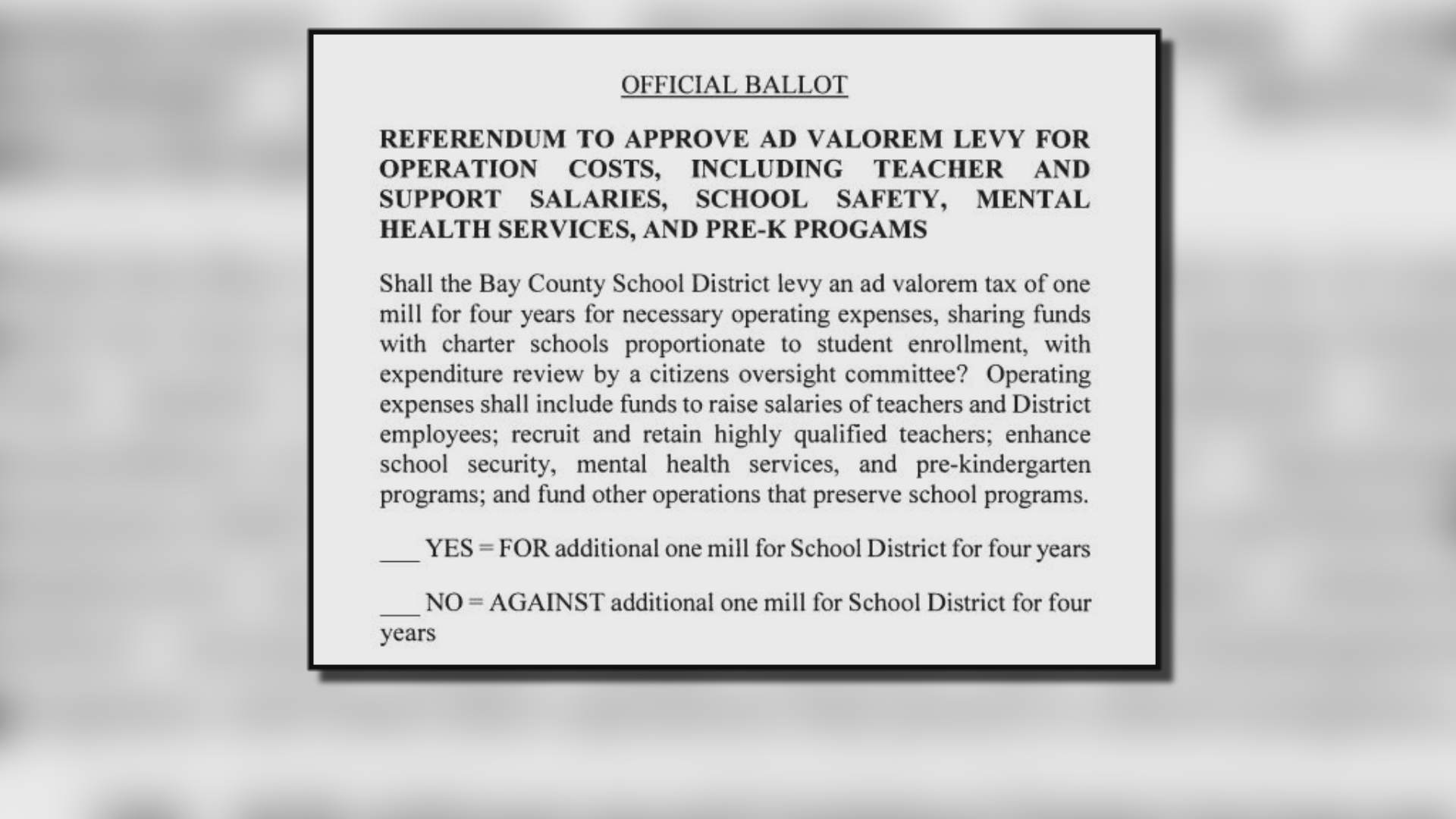

Sales tax is applied to goods and services at the point of purchase. The ballot language. WMBB Bay County voters will have the chance to vote in November yet again on whether to renew ad valorem tax exemptions for businesses.

Not Good Enough Florida 4095 State Road 7 Suite L-207 Lake Worth FL 33449-561 628-9311. 101173 District millage elections. Sales tax Sales tax is one of the primary taxes levied by state governments.

Ron DeSantis R on Friday signed a bill that aims to strip Disney of its self-governing authority in and around Walt Disney World but in their rush to punish Disney for opposing the new Dont Say Gay law Florida Republicans failed to notice an obscure provision in state law that says the state could not do what legislators were doing unless the districts. Property Tax Oversight Program. Aug 21 2020 0428 PM CDT.

This is the last of six on this years ballot and its full name is. Section 1961995 Florida Statutes requires that a referendum be held if. It is most often collected by the seller of the good or service and then transferred to.

The Municipal and County Ad valorem Tax Cap did not appear on the November 4 2008 statewide ballot in Florida as an initiated constitutional amendment. Provides that the homestead property tax discount for certain veterans with permanent combat-related disabilities carries over to such veterans surviving spouse who holds legal or beneficial title to and who permanently resides on the homestead property until he or she remarries or sells or otherwise disposes of the property. 1 AD VALOREM TAXES.

Sales tax Main article. 2 days agoAccording to Florida Statute 189072 dissolving a special district requires approval by a majority of landowners. An elected board may levy and assess ad valorem taxes on all taxable property in the district to construct operate and maintain district facilities and services to pay the principal of and interest on general obligation.

Newer Post Older Post Home. 101173 District millage elections. The 2021 Florida Statutes.

Below is the ballot summary that appeared on the ballot. The constitutional amendment increasing the amount of the residence homestead exemption from ad valorem taxation for public school purposes from 25000 to 40000 What. 1 The Board of County Commissioners or.

Amendments 5 And 6 On Florida S Ballot Focus On Florida Property Taxes The Independent Florida Alligator Share this post. The reduction of the amount of a limitation on the total amount of ad valorem taxes that may be imposed for general elementary and. OFFICIAL BALLOT BOLETA OFICIAL CONSTITUTIONAL AMENDMENT GENERAL AND SPECIAL ELECTIONS.

Ad valorem tax florida ballot Wednesday February 16 2022 Edit. Ad Valorem Tax Discount for Spouses of Certain Deceased Veterans. Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business.

5 External links. 2 days agoThe Reedy Creek Improvement District was established in 1967. The district school board pursuant to resolution adopted at a regular meeting shall direct the county commissioners to call an election at which the electors within the school districts may approve an ad valorem tax millage as.

2020 Florida Constitutional Amendments Ballot League Of Women Voters Of Orange County. 3 Oversee property tax administration. Providing for limiting increases in homestead property valuations for ad valorem tax purposes to a maximum of 3 annually and also providing for reassessment of market values upon changes in ownership.

Article VII Finance and Taxation. Ad Valorem property tax exemptions can be granted to new and expanding businesses only after the voters of a city andor county vote in a referendum to allow that city or county to grant exemptions. An Florida Ad Valorem Tax Cap Amendment did not make the November 6 2012 ballot in the state of Florida as an initiated constitutional amendmentIf enacted this measure would have mandated that no county or municipality shall levy ad valorem taxes on more than 30 percent of the value of any homestead property for certain seniors 40 percent of the value of.

The measure would have limited the power of local government to raise revenue from the ad valorem taxes - no county or municipality would have been allowed to levy ad. The land of Reedy Creek is. 21812 Appropriations to offset reductions in ad valorem tax revenue in.

The preceding tax year in the maximum compressed rate of the maintenance and operations taxes imposed for those. A yes supports authorizing the Florida State Legislature to provide an additional homestead property tax exemption on 50000 of assessed value on property owned by certain public service workers including teachers law enforcement officers emergency medical personnel active duty members of the military and Florida National Guard and child welfare service employees. Florida Department of Revenue.

1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually. Disney recently told investors the state would be unable to resolve the district without paying for the districts outstanding debt. 2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607.

4 Florida Amendments Pass 2 Do Not News Theonlinecurrent Com

How Freelancers And Contractors Can Remain Independent With Ab5 Business Insider Technology News Today Workers Rights Big Battle

Amendments 5 And 6 On Florida S Ballot Focus On Florida Property Taxes The Independent Florida Alligator

A Guide To The Constitutional Amendments On Florida S 2018 Ballot Wusf Public Media

Local Tax Referendum Ballot Bill Advances With Timing Solution Expected

Commission Votes 3 2 To Go Forward With 1 Mill Property Tax Increase Hernando Sun

Taking A Closer Look At The Bay District Schools Tax Referendum

Florida S State And Local Taxes Rank 48th For Fairness

Florida Voters Approve Two Property Tax Related Constitutional Amendments Dean Mead

Despite Skepticism Property Tax Exemption Moves One Step Closer To Becoming Law The Capitolist

/cloudfront-us-east-1.images.arcpublishing.com/gray/DT23GRZO2ZHALPZT5XDMUBIDJE.bmp)

Taking A Closer Look At The Bay District Schools Tax Referendum

Florida To Vote In November On Additional Property Tax Exemption For Certain Public Service Workers Ballotpedia News

Amendment 6 Ad Valorem Tax Discount For Spouses Of Certain Deceased Veterans Who Had Permanent Combat Related Disabilities 2020 Amendments Chronicleonline Com

Gardendale S Upcoming Tax Vote What You Need To Know

More Tax Breaks Possible For Some Are You Among Them Florida News Miamitimesonline Com

Understanding Your Vote Naples Florida Weekly

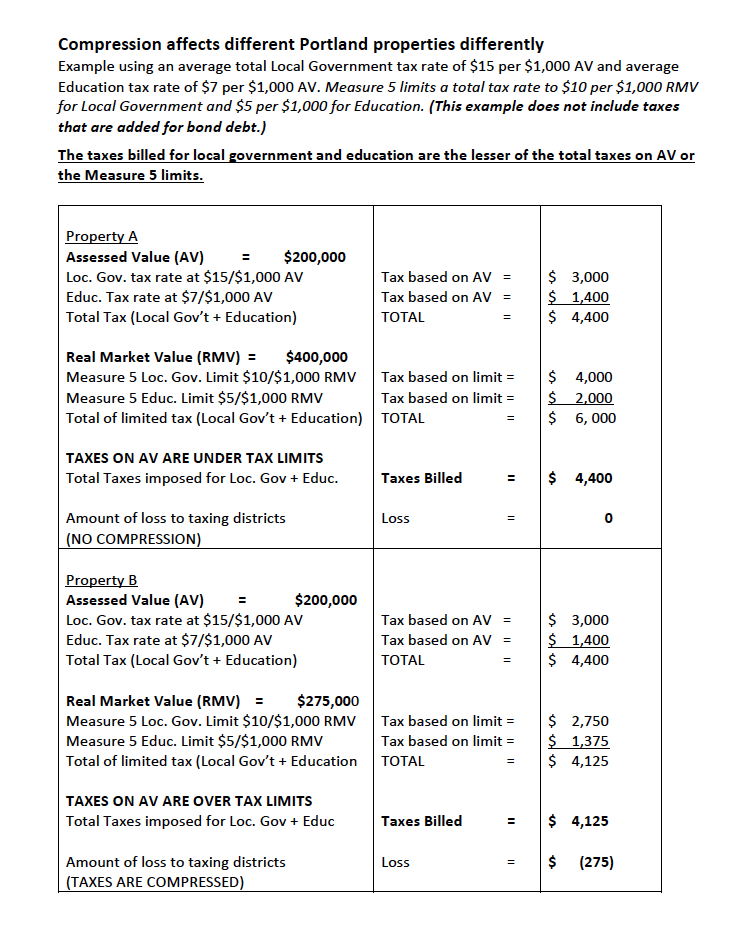

Property Taxes Compression Ballot Measures League Of Women Voters Of Portland

A Voter S Guide To The 2020 General Election

The Legislation Was Part Of A Pro Solar Ballot Initiative That Florida Voters Overwhelmingly Embraced Last Summ Best Solar Panels Solar Technology Solar Panels