nj bait tax form

Nonresident Withholding The new 2022 BAIT does not require a partnership or LLC taxed as a partnership to withhold New Jersey gross income tax. 2021 PTE-200-T Extension of Time to File.

Ami Shah Cpa Certified Public Accountant Ami Shah Cpa Pc Linkedin

24000 400K x 6 The NJ BAIT tax deducted at entity level would be added back to taxable earnings for the calculation of NJ income tax.

. PL2019 c320 enacted the Pass-Through Business Alternative Income Tax Act effective for tax years beginning on or after January 1 2020. Mine is single member SCorp. The BAIT is imposed at the following rates based on the collective sum of all the PTEs members shares of distributive proceeds for the tax year.

This was an important fix for consistency purposes but many issues remained due to the law as originally written and the Division of Taxations. Taxpayers who earn income from pass-through businesses and pay. PTEs wishing to pay the BAIT will be required to make quarterly estimated.

Income in excess of 1 million is taxed at 109. New Jersey Pass-Through Business Alternative Income Tax PTE Election. Taxpayers who earn income from pass-through businesses and pay.

If a New Jersey S corporation is a partner in a tiered partnership. Partners with a calendar year end of 123122 will claim credit for their share of the 2021 BAIT on their 2022 New Jersey tax returns. However my understanding is that the NJ BAIT payment is deductible as a business expense of the PTE in my case an S-Corp.

E-File Directly to the IRS State. Until 2022 there is a middle bracket of 912 for income between 1M and 5M. 1418750 652 over.

Were going to take a deduction for the New Jersey BAIT paid in 1581750 resulting in 25918250 a federal income and allocated the three ways 8639417. The New Jersey Business Alternative Income Tax also referred to as BAIT or NJ BAIT helps business owners mitigate the negative impact of the federal state and local tax SALT deduction cap. The following BAIT due dates have been extended from Mar.

The purpose of this NJ state approved program is to avoid the 10000. Each electing pass-through entity must submit form PTE-100 a PTE-K1 for every owner and form NJ-NR-A if the pass-through entity is conducting business both inside and outside NJ. Ad Download Or Email Form IT-R More Fillable Forms Register and Subscribe Now.

However as t he BAIT enables owners of PTEs to reduce their federal taxable income by remitting this entity-level tax on its New Jersey-sourced income where in. However it is not reported on the 1120-S schedule K-1. Ad Free 2021 Federal Tax Return.

If imitation is the highest form of flattery then New Jersey has much to be proud of in our leadership regarding the advancement of this effective and valuable tax legislation. 2021 PTE-100 Tax Return. Now if we apply the max rate in 2020 37 that will result in a tax of 31966 to each member.

Changes are effective for tax years beginning on and after January 1 2022. On the bottom of the form is a box for the members share of business alternative business income tax which should be reported on the business owners New Jersey personal return as a credit to offset any New Jersey tax liability. The NJ BAIT tax will be reported on a separate schedule called PTE K-1 Members Share of Tax Schedule.

With their New Jersey Gross Income Tax or Corporation Business Tax return to claim credit for their share of the tax paid. If the sum of each members share of distributive proceeds attributable to the pass-through entity is. Pass-through entities that have elected to pay the Pass-Through Business Alternative Income Tax must.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The New Jersey Business Alternative Income Tax also referred to as BAIT or NJ BAIT helps business owners mitigate the negative impact of the federal state and local tax SALT deduction cap. Returns due between March 15 2022 and June 15 2022 are due by June 15 2022This includes the 2021 PTE Election 2021 PTE-100 Tax Returns 2021 PTE-200-T 2021 Revocation forms and 2022 Estimated Payments.

Its estimated to save New Jersey business owners 200 to 400 million annually. The 2021 PTE-200-T Extension of Time to File grants a six-month extension to September 15 2022. Its estimated to save New Jersey business owners 200 to 400 million annually.

The New Jersey BAIT was so successful that 19 states followed suit and have adopted some form of PTE tax. Business owners should consult with their tax advisors to. Instructions for Completing the.

Pass-Through Business Alternative Income Tax Act. For New Jersey purposes income and losses of a pass-through entity are passed through to its. This law which took effect January 1st 2020 mitigates the impact of the federal 10000 state and local tax SALT deduction cap imposed as part of the Tax Cuts.

Amending a Nonresident Return. 419 revises the New Jersey elective pass-through entity business alternative income tax which was enacted in January 2020. Nonresidents should file Form NJ-1040NR and write the word Amended in bold letters in the upper right hand corner.

To access the NJ Pass-Through Business Alternative Income Tax PTE filing and payment service click here or copy and paste the below address into your web browser. 15 2022 to June 15 2022. Assume a PTE filed its 2021 BAIT return on March 1 2022.

February 23 2022 226 AM. In order to make a BAIT election an. On the share of the income of each nonresident entity owner if the entity owner expects to get the money back in the form of a tax credit as a result.

The New Jersey Business Alternative Income Tax also referred to as BAIT or NJ BAIT helps business. For the amount of tax paid on its share of distributive proceeds on Form NJ-1065 or claim it as a credit on its own Form PTE-100. Tax year for Form PTE-100 may be different from Form CBT-100S If filing for a fiscal year or a short tax year enter at the top of the PTE-100 the month day and year.

Bracket Changes As a result of the amendments the BAIT increases to the top rate of 109 on firm income over 1M. Ad The Leading Online Publisher of New Jersey-specific Legal Documents. The NJ BAIT tax payment is made by SCorp after registering at NJ Pass Thru BAIT.

Hence I need to record it as an expense on my 1040 to offset the income reported on the K-1. Premium State Tax Software With All the Extras Included. September 3 2021.

See the instructions for the appropriate return. For tax year 2021 NJ addressed many of these issues by revising the BAIT form calculations to be more in line with the income that will be flowing out to the partners members and shareholders. The New Jersey Business Alternative Income Tax or NJ BAIT allows pass-through businesses to pay income taxes at the entity level instead of the personal level.

Since the passage of the legislation the NJ Division of Taxation has created and updated its Frequently Asked Questions which contain general information about the BAIT as well as information on making the election making estimated tax payments and calculating the tax. Partners with a calendar year end of 123122 will claim credit for their share of the 2021 BAIT on their 2022 New Jersey tax returns. This information has been posted to the New Jersey Division of Taxations website.

Thanks very much for your reply. Pass-Through Business Alternative Income Tax Act. Get Access to the Largest Online Library of Legal Forms for Any State.

The New Jersey elective pass-through entity PTE tax known as the Business Alternative Income Tax or NJ BAIT became effective for tax years beginning on or after January 1 2020 but was revised on Jan 18 2022 with the changes placed into effect for January 1 2022.

New Jersey Pass Through Business Alternative Income Tax Act Curchin Nj Cpa

2555 Hi Res Stock Photography And Images Alamy

2555 Hi Res Stock Photography And Images Alamy

Usa Real Estate Agent Tax Deduction Checklist Download

2555 Hi Res Stock Photography And Images Alamy

New Jersey Pass Through Business Alternative Income Tax Act Curchin Nj Cpa

Form Rut 75 Fill Out And Sign Printable Pdf Template Signnow

Travel Reimbursement Form Template Fresh Mileage Reimbursement Form Template Spreadsheet Template Report Template Book Template

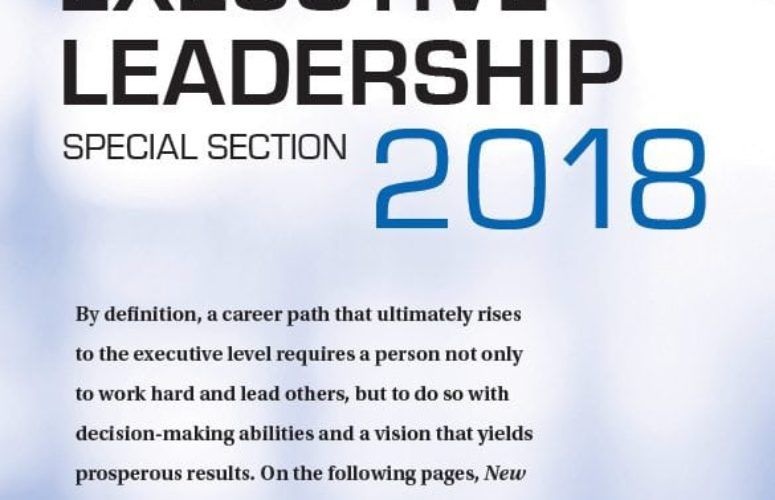

New Tax Option Can Lift Small Business Tax Burdens New Jersey Business Magazine

New Tax Option Can Lift Small Business Tax Burdens New Jersey Business Magazine

New Tax Option Can Lift Small Business Tax Burdens New Jersey Business Magazine

Oil Change Lounge Nj Woods Water

Massachusetts Sales Tax Small Business Guide Truic

New Tax Option Can Lift Small Business Tax Burdens New Jersey Business Magazine

New Tax Option Can Lift Small Business Tax Burdens New Jersey Business Magazine